Spanish Mortgages or home loans are the financial or banking product to which the average saver spends the most money. Getting a mortgage to buy a home in Spain is something very common among expats who are looking to move to Spain.

If you are thinking of getting a mortgage loan in 2023, you should carefully read this guide, so you can find a mortgage plan that suits your needs. Our recommendation is that you take some time to understand what a mortgage is and how it works, so you can take an informed decision.

Can I get a mortgage in Spain as a non resident?

Non Spanish Residents purchasing property in Spain will have no difficulty obtaining a Spanish mortgage. Keep in mind that non-EU people may face different requirements than EU nationals, and that expatriates looking for a Spanish mortgage would often face higher rates and less funding.

Non resident Spanish Mortgages interest rates

While mortgage interest rates for Spanish residents are at historic lows with many new mortgages having rates of 1% or less, non-resident spanish mortgages can be subject to interest rates of at least 2-2.5%. Non-resident mortgages in Spain are normally fixed rate and have a term of no more than 20 years.

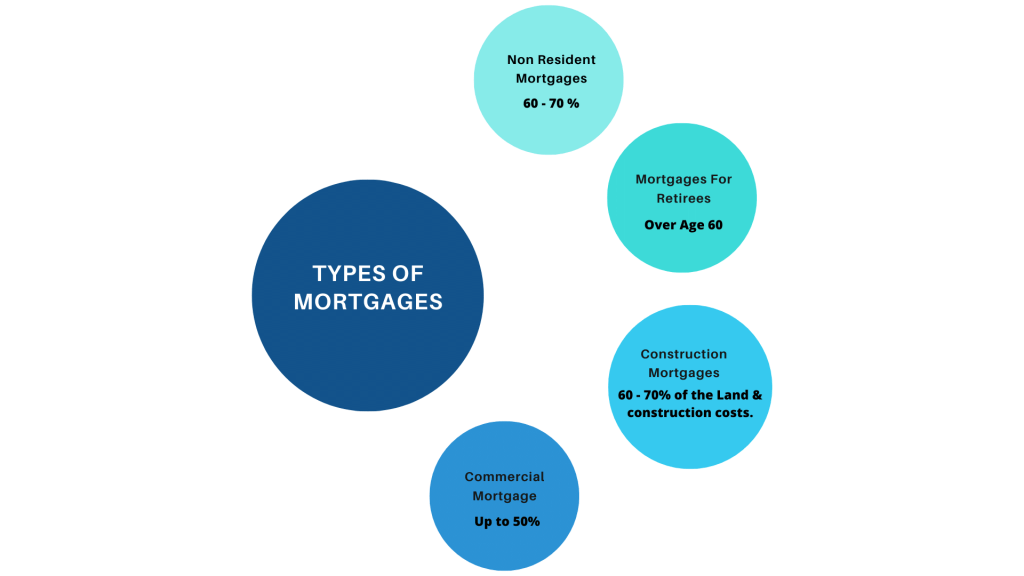

Types of Spanish mortgages

Spain offers the usual types of spanish mortgages, with additional expat-focused Spanish mortgages offered by international banks and Spanish banks. Many Spanish mortgages have no restrictions on purchase price or nationality, though some products favor buyers from specific countries, or buying property in certain regions. But, what are the usual mortgage types?

Non-Resident vs. Resident SPANISH MORTGAGES

The biggest difference between residential and non-residential loans is the maximum loan-to-value (LTV) that banks will allow. Residents can generally borrow up to 80% of the property’s assessed value whereas non-residents are limited to 60–70% LTV, depending on the mortgage type. The good news is that it may be possible to borrow significantly more of the property’s value – up to 100% in some cases – when buying a bank’s repossessed property in Spain.Some banks might only be willing to provide a mortgage to foreign buyers for their own real estate listings. In this case, your options for getting a mortgage may be closely tied to a particular property. In some cases, the mortgage you get may be based on the bank assessor’s valuation of the property rather than the price you’re paying for it. Thus, if an assessor valued your property at €125,000, you could traditionally borrow up to €87,500, even if your purchase price was only €100,000.

Getting a Mortgage as Retiree in Spain

If you are looking to retire in Spain, and are over age 60, you can have a mortgage as long as you are in receipt of a pension. When applying for a retiree mortgage, you can appoint a guarantor such as a family member to secure the borrowing. By doing this, you might be able to benefit from some tax advantages, in case the mentioned guarantor is also part-owner of the property.

GETTING A MORTGAGE FOR A COMMERCIAL PROPERTY

In case you are setting up a business in Spain, you may want to buy a restaurant or a shop for example. In this case, you can fund your investment by applying to a commercial spanish mortgages. When it comes to commercial loans, the requirements are a little bit different than usual. In this case, the bank or the lenders, will ask you for all the documentation related to the business you intend to run. So you must present your business plans, accounts for any previous businesses and demonstrate previous experience. Commercial loans can be used to fund a maximum of 50% of the price or valuation of the business you intend to buy.

CONSTRUCTION spanish MORTGAGES

If you wish to build your own home in Spain, you can apply for a construction mortgage. Construction mortgages are complicated, and the funding you may be able to get depends a lot on your case. Broadly speaking, you may be able to borrow about 60 – 70% of the land and construction costs combined. The interest rate of a construction mortgage will be higher, as the risk associated with an unfinished project is higher as well.

Getting a mortgage as a Non Resident in Spain.

It is a fact that more and more foreigners are buying homes in Spain. According to the data provided by the Property Registry in Spain, last year more than 61,000 houses were purchased by foreigners, which accounted for 13% of transactions. In fact, 7% of the mortgages issued in Spain for the purchase of a property were signed by foreign citizens.

Mortgages for non-residents are loans granted by financial entities to foreign nationals or citizens who do not have residence in national territory, that is, who have either not stayed in national territory more than 183 days during the calendar year, or who do not have the main focus of their activities in Spain. In other words, this modality of mortgage loan is valid for those who pay their taxes outside the Spanish territory, regardless of their nationality.

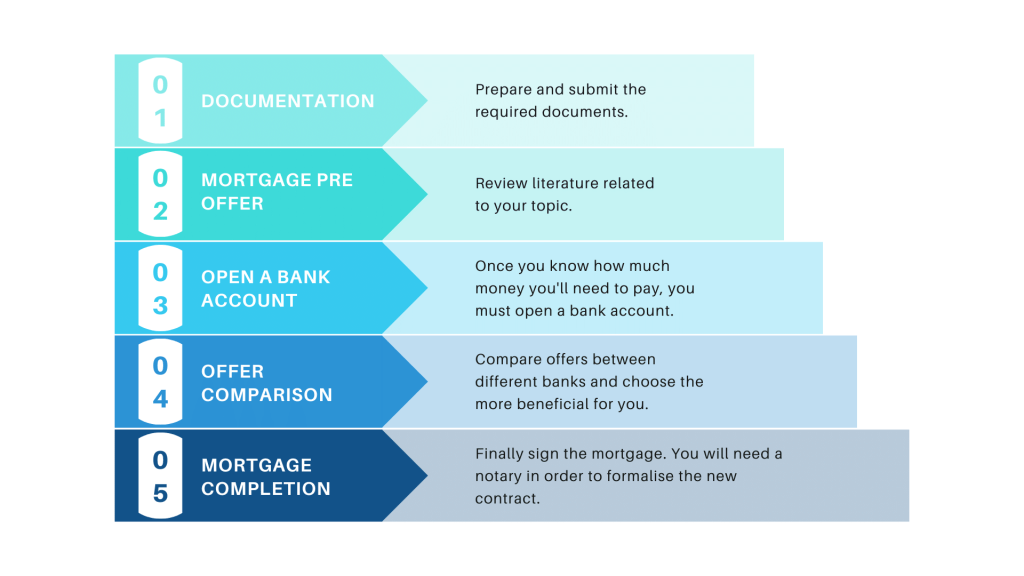

STEPS TO GET THE NON-RESIDENT SPANISH MORTGAGE IN SPAIN

In order to apply for a mortgage as a foreigner, we have prepared this 5-step guide:

1. Prepare the required documentation

Below you will find all the required documents that you must send to your bank. This documents will help the bank asses your risk profile, by letting them know your level of income and debt.

Required Documents to get the mortgage.

The required documents when applying for a non-resident mortgage loan would be the following:

- Photocopy of the NIE or passport.

- Certificate indicating that you are not a resident in Spain.

- Employment contract.

- Last payslips obtained in your country of residence.

- Bank statement for the last year in which the salary is paid.

- Tax return.

- Certificate of tax residence.

- Contract of the house to be bought.

- Last three receipts of outstanding debts that have been cancelled.

It will also be necessary to have all the necessary documentation translated into Spanish and a Spanish bank account, as well as to present the originals in person, although it is true that more and more financial institutions are accepting to receive the scanned documentation.

2. Compare between different banks and ask for pre-offers

Once you have all the necessary documents it’s time for some mortgage research! You can check what are the best banks in Spain to get a mortgage, and start asking for pre offers. In order to ask for a pre offer you just need to send the required document to the bank you think is more suitable to your situation, and they will make you an offer.

3. Open a bank account

By looking at all the offers, you will be able to figure out how much you need to pay and when. This way, you can open a bank account and deposit the money you’ll need to fund the mortgage.

4. Compare Offers and Choose The best option

Compare the different offers you receive and decide which bank is the one that best will fit your needs.

5. Mortgage Signature

Finally, the time will come and you will have to sign the mortgage. At this point you may need a notary, in order to formalise all the paperwork.

TAKE INTO ACCOUNT: Even though life insurance is not required when applying for the mortgage, some banks may ask you to get a property insurance, so you should be prepared.

Requirements for getting a NON RESIDENT SPANISH mortgage

The conditions that must be met by citizens who require a spanish mortgage for non-residents are more demanding than those of citizens who are resident in Spain. Why? The reason is that in case of default and non-payment, there is a much greater difficulty in seizing assets from abroad and the only guarantee would be the property acquired in Spain.

For this reason, the percentage of financing granted in mortgages for non-residents is not as high as in other mortgage loans, which means that the client who wants to access a mortgage must have a greater amount of savings to pay the initial expenses. The percentage of financing for this type of mortgage is around 60%. As for the repayment period, this is usually around 20 years at most.

The interest rate applied to the capital loaned is higher in the case of spanish mortgages for non-residents than for residents, partly because it is more difficult to comply with the purchase of products linked to the mortgage, such as the direct deposit of the salary. In addition, with a fixed-rate mortgage for non-residents, the customer will know exactly how much to pay back and will be able to rent the home knowing the return he will get.

We can offer you the best spanish mortgages, as we talk to many banks and have 100 spanish mortgages for non residents such as santander spanish mortgage calculator…

FAQs on Getting a Mortgage in Spain

How much can the bank lend you for your mortgage?

When choosing a home, the entity to which you ask for the loan will not normally lend you 100% of its value. That is to say, if your dream home is valued at 200,000 euros, the bank will grant you, as a maximum, a loan for an amount not exceeding 80% of the appraisal value of the property. Although, depending on the entity and your particular characteristics, you can get a higher percentage. From this maximum it is clear that it is essential to have savings available before buying a home. At least, to face the appraisal expenses, agency or those related to the Registry of the Property. This will mean around 30% of the price of the property, since you will have to have 20% of savings and approximately 10% to face the additional costs.

Who should pay the costs of setting up a mortgage?

The banks will be in charge of assuming the costs linked to the signing of the loan, such as agency fees, notary fees, registration fees and the tax on documented legal acts (AJD). In this way, the client will only pay for the appraisal of the property to be acquired, an indispensable requirement for the granting of the mortgage, which ranges from 300 to 600 euros, although the client will be free to choose the appraisers.

How much deposit do I need for a mortgage in Spain?

For a Spanish mortgage, you will generally need a minimum deposit of 30% of the property’s purchase price, with borrowing rates currently starting around 2% (lower for premium clients). “The maximum mortgage for non-residents is 70% of the purchase price or valuation, usually depending on which is lower.

How long does it take to get a Spanish mortgage?

To obtain the Spanish bank’s agreement is takes typically around 4 to 6 weeks.

Can foreigners get a spanish mortgages?

Yes, foreigners can get a mortgage up to 70% of the Value of a property.

Do I need a Spanish bank account to buy a property in Spain?

The obvious answer is yes. You want to finance a property in Spain, you will have taxes, utilities … Get it right away. In order to open your bank account, you will need a NIE.

Appreciating the dedication you put into your blog and detailed information you provide. It’s nice to come across a blog every once in a while that isn’t the same old rehashed information. Great read! I’ve saved your site and I’m including your RSS feeds to my Google account.

Thank you! Appreciate it!

Great blog! Thank you! Two questions:

All advice about opening a bank account says you need an address, but you can’t rent or buy without a bank account. Which comes first?

Are there websites that feature bank owned properties?

Hi! Thanks for your comment.

We would recommend that you first have your address in place, specially if you are looking to buy a property.

We don’t know about any website that specifically features bank owned properties, but you can look in Idealista, or Fotocasa, and you’ll probably find an option there that allows you to filter and find “bank owned properties”.

Cheers

This is such an informative blog! Great job! I have a question. If I buy a property with a mortgage and then decide to sell, is there a penalty for prepayment? Thanks

Hi there! Thank you for your comment! We appreciate that you like our blog!

You can buy property and then decide to sell. Actually, not only can you sell a house that has been mortgaged by the bank, but there are three different ways to do it:

– Sell the house and cancel the mortgage.

– Subrogate the mortgage to the buyer: When selling a house with a mortgage, it is possible that the buyer assumes that debt when acquiring the property. This concept is called subrogation of a mortgage.

– Apply for a bridge mortgage: Among the ways to sell a mortgaged house, the most unknown and, therefore, the least common is to apply for a bridge mortgage to your bank.

This is the ideal option when you need to buy a house urgently or reinvest in a house, but you still haven’t managed to sell the one you have now.

Selling a home and paying off the mortgage is the most common and simple practice.

Great Blog!

Could you tell please what are the cases to get 100% mortgage? Is it still posslible?

Yes, it’s possible but depend your situation

what situations can increase the % that can be mortgaged?

Do I qualify for a low mortgage rate as resident Spanish people get by having a TIE?

Hi Andrew,

one of our lawyers should be in contact with you shortly for your questions.

Greetings

Thank you for a informative article!

I was wondering, do Spanish banks cause trouble for non-Spanish residents when applying for a mortgage in Spain, due to article 20 of the Spanish Mortgage Act (Ley de Contratos de Crédito Inmobiliario 5/2019)?

My cousin is from Israel and wishes to take out a mortgage on an investment property in Spain. Is that possible? If so, what terms and limitations can be expected?

Thank you.

Hi Lucy,

one of our lawyers should be in contact with you questions.

Kind regards

Great blog and very informative. Thank you. Would you recommend applying for a mortgage via a broker or going to the bank directly?

Majella,

We always put our clients in contact with one of our brokers who will negotiate mortgages with the best conditions for our clients.

Regards,

I was wondering what the minimum amount is for a mortgage as a foreigner. I have a fair amount of my own money I want to put in but I’m off by a few tens of thousands.

There is no minimum amount to get a mortgage as a non-resident, it all depends on your situation, if you want you can contact us through our form and explain us your situation, salary, money you need, value of the property… We will be happy to obtain the best mortgage for you.