The moment someone plans to start living abroad, Spain easily comes to mind as a destination country. The pleasant climatic conditions, the amazing landscape, the charm of the people, the delicious Mediterranean food… Everything makes it inevitable that Spain will be an attractive country for foreigners. However, like any other country, it has something that no foreigner enjoys: taxes in Spain.

Navigating the intricate world of taxes in Spain can be a challenging endeavor, but at MySpanishResidency.com, we are here to provide expert guidance and solutions. Our dedicated team can help you make sense of the tax landscape in Spain and ensure that your international transition is as smooth and financially efficient as possible.

Do expats pay taxes in Spain?

Yes, expats in Spain need to pay taxes. The most basic tax that expats must pay in Spain is the income tax. The income tax is calculated upon the expat’s worldwide income. However, if you are a Spanish non-resident, the income tax is calculated just upon the income generated in Spain.

In this section, we will answer that question. We’ll see what exactly are the taxes in Spain for non residents during 2024.

Taxes in spain for non residents

To determine exactly what specific taxes you will pay in Spain as a foreigner and what the amount will be, you must first know whether you are a resident in tax terms or not.

This distinction, as we mentioned, is merely fiscal in nature, and has nothing to do with the residence permit you may have to live legally in the country. This means that you may or may not have obtained a formal residence permit, but if you meet the requirements we will now discuss, you will still be considered a resident for tax purposes.

WHAT IS THE INCOME TAX FOR NON RESIDENTS IN SPAIN?

Income acquired without a PE is taxed at the following rates for non-residents:

- The general rate is 24%. The rate is 19% for residents of other EU member states or European Economic Area (EEA) nations with which there is an effective exchange of tax information.

- Capital gains from asset transfers are taxed at a 19% rate.

- The interest rate is 19%. For EU residents, interest is tax-free, as double taxation treaties (DTTs) often set lower rates.

- Dividends: 19%

- Royalties are taxed at 24%

- Pensions are taxed at a graduated scale (between 8 percent and 40 percent).

How do I know if I am a tax resident in Spain?

You will be considered a tax resident if you meet one of the following three requirements:

- You live in Spain more than 183 days per year (note that the days do not have to be consecutive to count as effective).

- You have economic interests in the country, which means that you carry out your professional activity in Spain, either working for a company or working as a self-employed person.

- Your spouse and/or children live in Spain.

Income tax in Spain for Expats

IS INCOME TAX HIGH IN SPAIN?

Non-resident taxpayers are generally taxed at a flat rate on income earned in Spain or derived from Spanish sources, at a rate of 24 percent for labor income and 19 percent for capital gains and financial investment income derived from Spanish sources.

What is taxed under the income tax in Spain?

These are, broadly speaking, the incomes for which you will be taxed under the capital gains tax in Spain:

- Wages earned as an employee and what you earn as a self-employed person through your bills;

- Capital gains from, for example, dividends; and pension contributions and benefits.

If you are considered a tax resident in Spain (see above), you will have to pay income taxes for your income and profits, even if they are not coming from Spanish sources.

Paying non resident taxES in Spain

In that case you are non resident in Spain, that’s good news for you: you will only have to pay income tax on the income you have generated in Spain, and that will be all.

The tax rates in spain for non residents are fixed at 25% on the gross income (not as with the income tax for residents, which is progressive). It is the so-called non-resident tax in Spain.

Suppose, for example, that you live in the UK but have a property in Spain. In that case you will only be taxed on all the income you generate by renting the property on the Peninsula.

The bad news is that you will not be able to deduct any expenses in this scenario.

How much income tax do you pay in Spain as a resident?

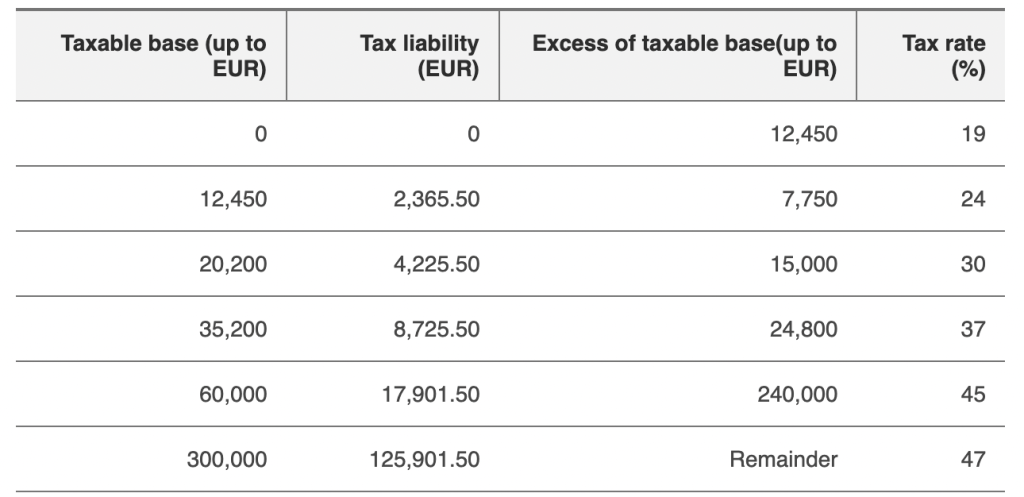

That depends on the exact income you generate around the world. This means that this tax is progressive and works as follows:

- Below the first €12,450 you earn, you will pay 19% of the income tax.

- From €12,450 to €20,200, you owe the Spanish Tax Agency 24%.

- From €20,200 to €35,200, 30%.

- From €35,200 to €60,000, 37%.

- And above 60,000 €, 45%.

Contrary to the case of non-residents, in this case you can have personal deductions and allowances.

As we are talking about particular cases and there is no general advice, we suggest that you contact with a team of tax advisors so that they can provide you with the personalised assistance you need to optimise your taxes in Spain.

If you dislike tax rates in Spain, the Beckham Act is for you.

If you are an expat starting to live in Spain, you will be able to save money with the Beckham Law, since its application will allow you to pay only a fixed fee of 25% of your income, never more than that. This means that you will be considered a non-resident for tax purposes.

What are the spanish tax allowances in 2024?

Residents in Spain have the right to different Spanish tax deductions. The general personal allowance for everyone under the age of 65 is set at €5,550, or €6,700 from age 65, and €8,100 from age 75.

In the case of families with children under 25, where all family members share the same home, it’s possible to claim the following additional allowances:

- €2,400 for the first child

- €2,700 for the second child

- €4,000 for the third child

- €4,500 for the fourth child

Having a child under 3 years will also grant Spanish taxpayer an additional allowance of €2,800.

In the case of families where a parent or a grandparent is living with the family, and the total income is less than €8,000/year, you can claim an allowance of €1,150 if they are over 65 and €2,550 if they are over 75.

In general, you can claim tax deductions in Spain for:

- Payments into the Spanish social security system;

- Pension contributions;

- The costs of buying and renovating your main home;

- Charitable donations

What are tax allowances for Spanish Residents?

Tax deductions are available to residents of Spain. The basic personal allowance is €5,550 for those under the age of 65, €6,700 for those over 65, and €8,100 for those over 75. You can claim an additional allowance of €2,400 if you have children under the age of 25 living with you.

Wealth Tax in Spain

Do you own any land in Spain? Then, regardless of whether or not you are considered a tax citizen, you will continue to pay the wealth tax in Spain. And we’re not only talking about land or properties in Spain. The inheritance tax extends on assets worldwide.

What is the wealth tax in Spain?

The wealth tax in Spain is a progressive tax. The higher the worth of your possessions, the higher the price you will pay. Varying autonomous areas have different wealth taxes in place, while others don’t have any at all. In general, the wealth tax in Spain is between 0.2 and 2.5 percent. More information is provided below.

The wealth tax is only applied to highly priced properties. This means that you have a tax salary of €700,000 (in Catalonia, €500,000). Assets such as land, vehicles , aircraft, deposits and savings, artwork, … these are the kinds of assets that would be charged here. Besides, if we are talking about your own land, you have an additional credit of 300.000€. If you own properties of a smaller worth than that, you will not have to think about the Spanish income levy.

So let’s say that you do. It is the case , for instance, that you own a property valued at 1,5 M€. How much are you supposed to pay then? The tax on capital varies from 0,2% to 2,5%. However, only the value of the property that exceeds the corresponding allowance will be applied to that percentage. Again, we are facing a progressive tax: the higher your assets’ value, the higher your tax rate would be.

If you are investing in Real Estate to get the Spanish Golden Visa you might want to have a look at the wealth tax.

These numbers can be taken as a general rule, since they will be higher based on the place you live in. In comparison, higher allowances are present in certain autonomous communities.

Find Information about specific taxes in spain

Property Tax in Spain

Find out what taxes you will pay for your property in Spain.

Beckham Law

Save taxes with the Beckham Law. Click for more info.

Inheritance Tax Spain

Find practical information about taxes in Spain for foreigners and Income taxes for non residents in Spain.

Spanish VAT Number

Everything to know about VAT Number in Spain.

Best Banks in Spain

Click here and check the best banks in Spain.

Frequently Asked Questions about Taxes in Spain

What taxes do non residents pay in Spain?

Most of the non residents in Spain will be subject to the Income Tax (IRPF). Non residents possessing highly valuable assets will be subject the wealth tax in Spain. Those non residents inheriting assets or receiving donations will be subject to the inheritance tax in Spain. Those foreigners selling any kind of asset and making a profit for it, will also be subject to the capital gains tax.

Do I have Capital Gains Tax obligations in Spain for the sale of my former home in my home country?

Currently, for the money they earn abroad, Spanish tax citizens do not have to pay capital gains tax. However, if you are a non-resident, you would only be taxed on the sale’s money if the property was situated in Spain.

How much is the income tax in Spain?

In general, non-resident taxpayers are taxed at a rate of 24% on income received or derived from Spanish sources in Spanish territory and at a rate of 19% on capital gains and financial investment income derived from Spanish sources.

Do expats pay taxes in Spain?

The most basic tax that expats must pay in Spain is the income tax. The income tax is calculated upon the expat’s worldwide income. However, if you are a Spanish non-resident, the income tax is calculated just upon the income generated in Spain.

I am looking for details about what U.S. asset classes are subject to or excluded from the wealth tax. This would include U.S. property, IRAs, 401Ks, brokerage accounts, etc. If I become a retiree in Spain do I have to pay on these assets in the States?

Hi Sean, one of our lawyers should be in contact with you shortly for your questions about taxes

Hello Sean,

I have exactly the same question. Did you get any insights?

Best regards

Karsten

Hi Karsten, one of our lawyers should be in contact with you shortly for your questions about taxes

Regards,

I too have similar questions. I have money invested in the US market and pay taxes on it here, if I retire in Spain do I have to pay taxes on it a second time?

Rosa,

one of our lawyers should be in contact with your questions.

Regards,

I’d like info on this as well, please

You can contact us through the contact form on the website to receive more information.

We are applied for a residency permit before Christmas as we want to retire in Spain. We have a bank account and are paying ( a lot!) for insurance. We don’t want to pay tax (only me with pension) so under 182 days is fine, but can we get more than the Schengen 90 days? It seems unclear and we’re still in the UK. Thanks

Hi Glenn, one of our lawyers should be in contact with you shortly for your questions about taxes in Spain

Greetings

I’m British, recently moved to Madrid and am trying to register as self-employed (autónomo) but am still in the process of getting my TIE card. I believe I need to pay tax quarterly (ie the first quarter will be due now) but as I don’t have my TIE yet I don’t know how to do this. Any advice.

Hi Nigel,

one of our lawyers should be in contact with you shortly for your questions about your questions

Greetings

Hi there,

I am a US citizen, and I was a resident of Spain until recently. Due to the pandemic, I lost my job in Spain (where I had been working for over one year). As a result, I received a prestación individual from November 2020 to February 2021. I am now back in the US, where I have found new employment. My fquestion: Do you have to pay taxes on prestaciones individuales?

Hi Paige,

one of our lawyers should be in contact with you shortly for your questions.

Greetings

Is the English Government Old Age Pension taxed in Spain?

Should it be included in Total Annual income declared in Spain?

Should the English Government Old Age Pension be included in Total Annual income declared in for Spanish Income tax?

Hi Ann,

one of our lawyers should be in contact with you shortly for your questions about taxes

Greetings

Hello,

I am a dual citizen US/SPAIN with a US Government Pension from my work in the federal government.

When I become a tax resident in Spain, what government will tax my public government pension?

Thanks

Hi Eddie,

one of our lawyers should be in contact with you shortly for your questions.

Greetings

We (myself, wife, currently 15 yr old twins) are contemplating moving to Spain (Asturias, either Gijon or Oviedo) from the USA after the twins graduate high school in June 2024. My wife and I will be 64-1/2 at that time. In round figures, can you give me an idea of how much we would pay initially, and annually, in taxes on a home purchase of approximately 200,000 Euros and combined monthly retirement income of $5000 Euros? We would also likely have an additional $100,000 Euros to place in a bank or invest, which I assume will also have tax implications. The answers to these questions will largely determine whether the move will be a financially sound decision for us. Thank you in advance for your reply, sent to my email address, below.

Hi Brian,

one of our lawyers should be in contact with you shortly for your questions.

Greetings

My wife and I are US citizens contemplating retirement in Spain having just returned from holiday in Costa del Sol region. Timing is still TBD but most probably late 2023. In retirement our income sources would be a combination of US social security, private pension, and pretax 401K and pre tax IRA distributions. In the short term (2024-2029) we will have children attending university in the US. To pay for that education I anticipate higher IRA distributions which will boost total income above $100K annually. In the longer term beyond 2029 our anticipated retirement income is approx US$79-80K (E$64-65K). My understanding is that under US-Spain tax treaty we would not be subject to double taxation and tax liability would not exceed the applicable tax rate of higher country. As such my tax liability would ultimately be based on Spanish tax law. Can you confirm my understanding? And that the higher IRA distribution in the short term will unavoidably result in higher taxation in Spain regardless of the fact that money will be used for college expense back in US. Again please confirm.

Hi Joseph,

one of our lawyers should be in contact with you questions.

Kind regards

How much tax do you pay if you choose to move to Spain to retire as a foreigner?

Anthony,

It all depends on your income…

Kind Regards,

Hello, I’m a retired teacher from Canada. My husband and I would like to move to Spain in the near future. I also hold a Spanish passport. Could you tell us how much my pension will be taxed in Spain? I will be paying non-resident taxes in the amount of 15% in Canada. Thank you.

Hi Margot,

one of our lawyers should be in contact with you questions.

Kind regards

Hello, we are moving to spain in 4 months.

We will probably rent a property first and buy one later.

I will still be working overseas as i am now.(offshore)

Can you inform me on income tax?

As far as i can see this will be 45% above 60000 euro’s, is this correct

Ron,

one of our lawyers should be in contact with your questions about Taxes in Spain

Regards,

Ive just moved the canary islands in Mid July 2022 on a non lucrative visa. Do we declare income from before we moved here. Our 187 days is end of December. Or does it get taken from the date we entered the country? Thank you

If you stay more than 183 days in any country you will have to pay taxes in that country.

Look at relocating to Valencia from Canada as a digital nomad and wondering if you could clarify what taxes I would have to pay ? All my income would be coming from Canada.

Jody,

The digital nomad visa will be approved in January 2023, you will have to wait until the visa is approved before you can come to live in Spain. If you need more information you can contact us.