The Golden Visa, a notable initiative, extends a residence visa to non-EU citizens who engage in a real estate investment in Spain amounting to or exceeding 500,000 euros. Launched in Spain in 2013 and also operational in various other countries, including Malta, Portugal, and the United Kingdom, the Golden Visa program is designed to entice foreign investors seeking to acquire homes and properties. In exchange, they benefit from facilitated access to a Spanish residence permit.

This visa option presents a unique gateway for investors to secure their place in Spain’s thriving real estate market while enjoying the privileges of legal residency. In this article, we’ll explore the Golden Visa in depth, covering its eligibility criteria, application process, benefits, and the role of our specialized immigration law firm in assisting investors on their journey to Spanish residency.

What are the benefits and can I apply for the golden visa Spain?

The golden visa is a visa that allows you to live and work in Spain. It can be applied for by anyone who has bought a property without a mortgage of more than 500.000€, people who have deposited 1 million euros in a Spanish bank or people who have bought shares for 1 million euros.

The so-called Golden Visa is a residence visa for non-EU citizens who make a real estate investment in Spain equal to or greater than 500,000 euros. The aim of the Golden Visa, approved in Spain in 2013 and also in force in other countries such as Malta, Portugal or the United Kingdom, is to attract foreign investors who want to buy homes or other properties and who, in return, are made easier to obtain a residence permit.

Contact us if you want to get the golden visa to live in Spain!

| Visa Name | Golden Visa |

| Description: | Residence visa for non-EU citizens who make an investment in Spain. |

| Duration of the permit | 3 years |

| Payable Taxes | If you spend less than 6 months in Spain you just pay taxes on your assets in the country. Check our tax information page. |

| Main Requirement | Minimum investment of 500.000€ in Real Estate |

Golden Visa Spain: Application Requirements

In order to successfully apply for a Golden Visa during 2024, the applicant must meet the following requirements:

- You must be a resident of a country outside the European Union. You must not forget that it is intended for investors from outside Europe.

- Be over 18 years of age.

- Have no criminal record.

- Have a private medical insurance in Spain.

- Demonstrate that you have sufficient financial means to live in Spain and support your family.

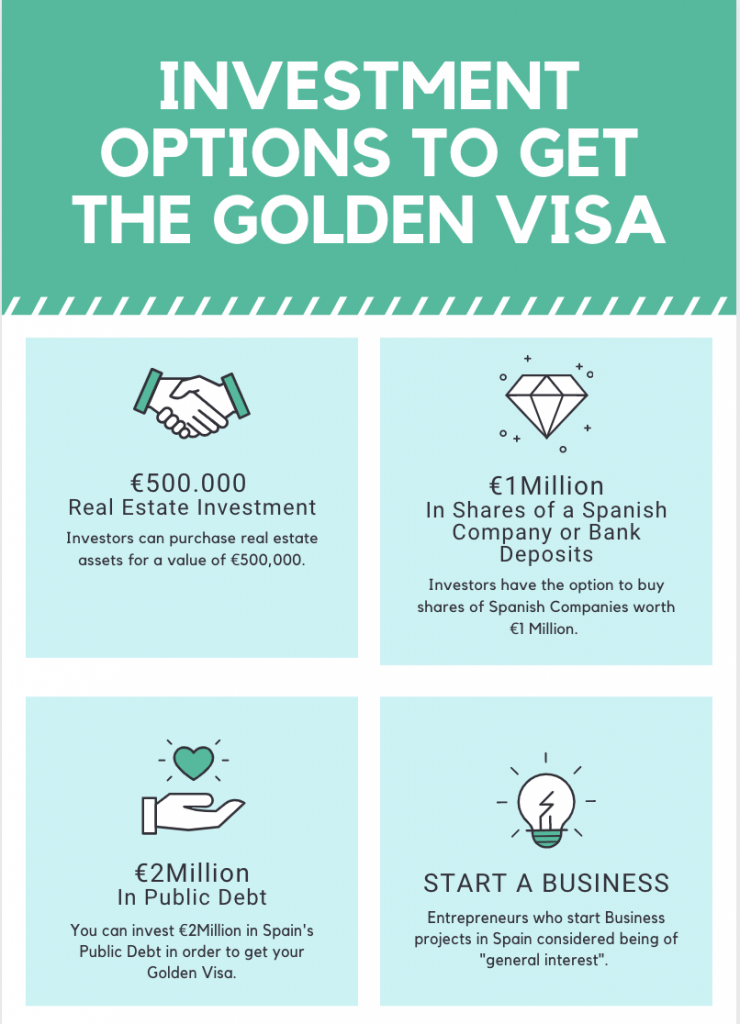

- Make the corresponding investment which, depending on which one it is, will be of one amount or another. Here you have a list of all possible investments:

- Make an investment in public debt for an amount equal to or greater than two million euros.

- Make an investment in bank deposits in Spanish entities or in shares of Spanish companies worth more than one million euros.

- Buying a property in our country for a value greater than 500,000 euros.

- Start up a business in Spain that must meet the following requirements:

- To create jobs.

- With an important impact on the country or region at a socioeconomic level.

- That represents a scientific or technological novelty

Documentation needed to get the GOLDEN visa

We have seen how one of the fundamental requirements to obtain a residence visa for real estate investment is to demonstrate, by means of the corresponding document, that the investment has been made.

The question now is: which documents exactly justify this investment?

If we want to obtain the golden visa through the investment of real estate, we must provide as proof of the purchase of the property the certification of domains and charges of the Land Registry, and the deed of sale of the purchased assets.

In the case of investing in Spanish shares or participations: a declaration of the investment from the Investment Registry of the Ministry of Economy in the case of participations; and a certificate from the financial intermediary registered with the National Securities Market Commission (Comisión de Nacional de Mercado de Valores) for the purchase of shares.

If what we have done is invest in Spanish public debt, we will need a certificate from the Bank of Spain or the financial institution with which we have managed the investment in which we can clearly see how we are the holders of that purchase.

Finally, for investments in bank deposits, you will need the certificate issued by the financial institution with which you have contracted the deal, which states that you are the sole holder of that deposit.

Who can benefit from this Visa?

The golden visa is designed for all citizens from outside the European Union who intend to make an investment in Spain as a means to obtain their residency.

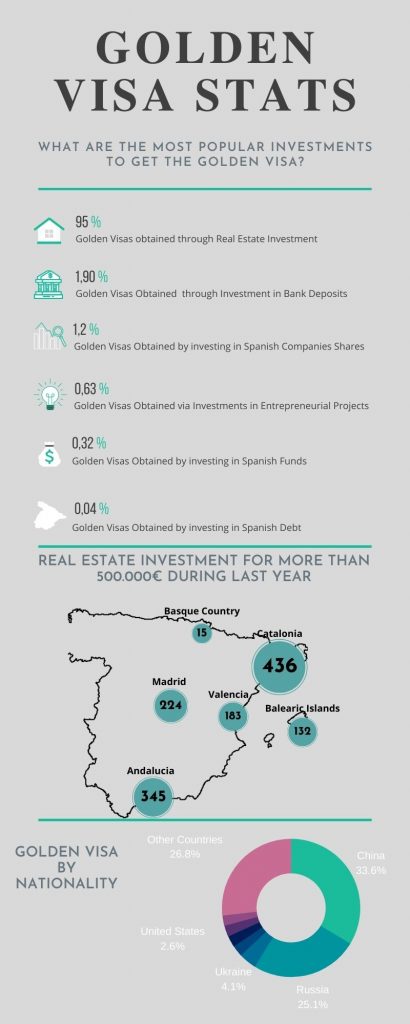

The countries in which this residence permit has gained the most popularity are China and Russia, without any doubt.

However, people from Iran, Venezuela, and Lebanon register notorious activity with this visa too.

Their main motivation? They have also found in investing in Spain a place to deposit their money; thus earning the ticket to a visa that largely avoids most of the procedures of the other permits.

Benefits of the Golden Visa

Preferential treatment is one of the main benefits of gold visas. With these visas you get the residence permit by the fast track, both for the first immediate grant valid for one year (if done in spain telematically with our lawyers it will be 3 years) and to process renewals every three years,” explains the lawyer.

In addition, the residence visa derived from the Golden Visa allows free movement through the rest of the 26 European countries of the Schengen area. This freedom of movement is highlighted as one of the main reasons for processing the visa for real estate investment. But there is more: the Golden Visa makes the granting of visas more flexible not only for the person making the investment but also for his spouse and for children under 18, and access to public schools. Newborns in Spain will obtain Spanish passports at the end of the year, without having to meet any other requirements.

Golden Visa Spain Taxes

When you buy real estate and obtain the Spanish residence permit, you will of course be liable to some tax. Which ones and how much depends on how much time you spend in Spain during the year. If you stay in Spain for over 6 months, you’re counted as a Spanish resident and your worldwide assets and income will be taxed in Spain. If you’re in the country for a less amount of time, you only pay taxes on the initial purchase of your real estate and thereafter on the value of your assets in Spain.

How much time does it take to get the golden visa in Spain?

Once all documentation has been submitted to the competent authority, 20 days may elapse before a decision is reached.

After having received this resolution with favourable results, we have a period of 1 month to apply for the visa at the Spanish consulate located in the investor’s country. It will be at that moment when we will have to travel to Spain, since we will have to present the Golden Visa application with the approval.

The next step will be to obtain the TIE (Tarjeta de Identidad del Extranjero), as well as the taking of fingerprints in any police station. Nor can we sleep in this procedure because we only have 1 month to do it.

If you don’t feel like spending the time required to carry out all these boring procedures… let us do it for you!

Contact us to get your Golden Visa: from beginning to end. You will only have to sign!

What is the duration of this residence permit?

Once the investor has obtained his golden visa, he will have 3 years to reside legally in the Spanish territory, If you have obtained the golden visa while in Spain, by submitting the application electronically.

If, on the other hand, you apply for the golden visa at the Spanish consulate, the visa is for one year.

Once this temporary period has elapsed, the applicant can request a renewal that will allow him to be a legal resident for an additional 5 years.

In order to carry out this procedure, the person in question must prove that he or she continues to own the asset that was the object of the investment, be it the property, the shares or the public debt.

In addition, you must have visited Spain at least once during the year.

Remember that the gold visa is one of the many ways to obtain Spanish nationality. After 10 years residing legally in Spain, the investor will be able to carry out the pertinent procedure.

ALLOWED INVESTMENTS TO GET THE GOLDEN VISA SPAIN

The requirements for obtaining the Golden Visa are established in articles 62, 63 and 64 of Law 14/2013.

There are 8 in total and, despite the fact that the most important capital expenditure is the most relevant, “all the information submitted to the file will be evaluated, no factor being, by itself, the evaluation of the concession” (Criterion 1.1. of Application of Law 14/2013). In other words, compliance with one condition does not replace compliance with others. That is why each and every one of them must be fulfilled.

SUBSTANTIAL INVESTMENT OF MONEY.

The most important condition refers to the fact of having made a substantial investment of money, which can be made in 6 different ways according to the provisions of Article 63.2 of Law 14/2013. One would be through the investment in real estate, another would be through the investment in real estate (including 4 assets) and finally, it would be investing in a corporate project of general interes

REAL ESTATE INVESTMENT

The value of the investment in real estate will amount to 500 thousand euros plus taxes (Article 63 b) of Law 14/2013).

In accordance with Article 64 b) of Law 14/2013, “the claimant must certify that he has obtained ownership of the property by means of certification of ownership and charges from the Land Registry corresponding to the property or properties”. The certification may incorporate an electronic verification code for online consultation. This qualification will include the volume of the acquisition; in any other case, it will be approved by the corresponding public deed.

The real estate investment must be equal or higher than 500 thousand euros plus taxes, but must be included in one or more properties of this type. This has been determined several times by the Spanish Courts. One of the decisions that have explained this point is the following:

“In addition, this derives from the literal wording of Article 63.1.b) of the aforementioned Law 14/2013, which refers to the value of the investment as ‘the purchase of real estate in Spain’, in the plural, which implies that the 500,000.00 euros do not have to have been invested in a single property, but it is also possible that it has been invested in more than one property” (STSJ d).

In order to comply with the real estate investment requirement, not only is it necessary for the property or the sum of the properties (if there are several) to have a valuation of at least 500 thousand Euros plus taxes, but that amount must also be free of charges or encumbrances. However, it should be noted that “the part of the investment that exceeds the necessary amount [500 thousand Euros] may be subject to a fee or tax” (Added by us / Article 64.b of Law 14/2013).

TAXES TO BE PAID TO OBTAIN THE GOLDEN VISA INVESTING IN REAL ESTATE

One of the aspects to take into account when applying for the golden visa is that we have to apply the taxes corresponding to the 500 thousand euros of investment. The general rule is that if it is a first transfer, the activity will be subject to the Value Added Tax (VAT). If it is a second or subsequent operation (sale of second-hand property), it will be subject to Transfer Tax (ITP)

The VAT rate or percentage applicable to real estate sales and purchases is 10%. In the case of ITP, the percentage may vary depending on the Autonomous Community in question. In the case of Madrid, for example, it is 6%.

An example of the above will be the following: if the purchase price is 500 thousand euros and the sale is subject to VAT, between the value of the property and the payment of the taxes it would be necessary to pay 550 thousand euros (500 thousand euros + 10% VAT).

Continuing with this assumption, but with the variant that the activity will be subject to ITP, an amount of 530 thousand (500 thousand) euros will have to be paid.

ALTERNATIVES TO REAL ESTATE INVESTMENT

In addition to real estate investment, there are other alternative investments that can help us get our Golden Visa.

SHARES OR SOCIAL PARTICIPATIONS

One million euros in shares or participations in Spanish capital companies with a current business activity. In accordance with Article 64 a) of Law 14/2013, the type of accreditation of these shares will be different depending on whether they are classified or unclassified shares. The article in question indicates what we transcribe below:

In case of investment in unlisted shares or participations, a copy of the investment declaration made in the Foreign Investment Registry of the Ministry of Economy and Competitiveness shall be submitted.

In the case of investment in listed shares, a certificate from the financial intermediary, duly registered with the National Securities Market Commission or the Bank of Spain, must be presented, stating that the interested party has made the investment for the purposes of this law.

INVESTMENT IN CLOSED-END INVESTMENT FUNDS OR VENTURE CAPITAL

One million euros in investment funds, closed-end investment funds or venture capital funds incorporated in Spain. The main thing in these cases is that the investment fund must be one of those included in the framework of the provisions of Law 35/2003, of November 4, on Collective Investment Institutions, or Law 22/2014, of November 12, which governs venture capital entities, other closed-end collective investment entities and companies that manage investment entities. In order to prove the investment “a certificate from the fund’s management company, incorporated in Spain, duly registered with the Spanish National Securities Market Commission, must be presented, stating that the interested party has made an investment of at least 1 million euros in a fund or funds under its control” (article 64.a) 4.o of Law 14/2013)

1 MILLION EUROS IN BANK DEPOSITS

One million euros in bank deposits in Spanish financial institutions. The method of accreditation of this investment shall be by the submission of a “certificate of the financial body of which the applicant is the sole holder of the bank deposit” (Article 64.a) 5th of Law 14/2013).

INVESTMENT OF 2 MILLION EUROS IN PUBLIC DEBT

Two million euros in Spanish public debt securities. For the purpose of accrediting the investment of public debt, ‘a certificate of the financial body or the Bank of Spain in which it is indicated that the applicant is the sole holder of the investment for a period equal to or greater than 5 years’ (Article 64.a) 3rd of Law 14/2013) shall be submitted.

BUSINESS INVESTMENT

Unlike the rest of the investments, in this case no minimum amount is established. However, a series of requirements are developed to decide what is a legitimate investment to receive the Golden Visa. Therefore, article 63.2.c) of Law 14/2013 specifies that the business proposal will be “considered and certified as being of general interest, for which the fulfillment of at least one of the following conditions will be evaluated.

- Creation of jobs.

- Making an investment with a significant socio-economic effect in the geographical area where the operation is to be established.

- Important contribution to scientific and/or technical progress.

Frequently Asked Questions on the Golden Visa

what is a golden visa?

The Golden Visa Spanish scheme is a new form of residency-by-investment visa program established by the Spanish Government in 2013. The software is targeted towards non-EU foreigners who would like to make at least €500,000 in capital spending or spending in real estate. Qualified applicants and immediate family members are issued with a residence visa, with possible pathways to permanent residence and Spanish citizenship.

How much do I need to invest in Spain to get the Golden Visa?

In order to be elegible for the Golden Visa, you need to invest at least in one of the following options:

– Land assets (€500,000)

– Shares or bank deposits (EUR 1 million)

– State debt (EUR 2 million)

– Enterprise ventures in Spain deemed to be of general interest.

How long does Spain’s Golden Visa last?

It’s a two-step operation. First of all, you need to comply with the requirements of the Spanish Investor Visa to receive a visa provided by the Spanish Consulate or Embassy. It permits you to travel to Spain, with multiple entries and exits, for one year. During this year, you are expected to fly to Spain and apply in person for your residence permit.

How much does it cost to get the Golden Visa?

This relies on what investing choice you want. You would need to buy real estate with a minimum valuation of EUR 500,000 for the option of a Spanish real estate visa. There is more than one property you can invest in. Another option will be to make a bank deposit of at least EUR 1,000,000 or to buy, instead, EUR 1,000,000 in Spanish company stock. Ultimately, you will have the ability to contribute €2,000,000 in government bonds.

What are the required documents for the Golden Visa Spain Application?

You’ll be required to provide the documents that contain evidence of the investment.

You’ll be asked to hand the certificate of property registration and real estate purchase deeds.

Unlisted stock and equity: acquisition declaration filed with the Ministry of Economy and Competition (Registro de Inversiones) Registry of Investments.

Listed shares: a financial broker’s statement which is registered with the National Stock Market Commission (CMNV) or the Bank of Spain.

Public debt: certificate from a financial institution or the Bank of Spain stating that the sole owner of the investment was the applicant for a period not less than five years.

Bank deposits: a financial institution certificate indicating that the applicant is the sole owner of a bank deposit.

Company project: a favorable report on business and entrepreneurial operations expected to take place in Spain is required before applying for a visa or permit.

spanish golden visa program and Information

Here’s some information about the Golden Visa demographics in Spain.

| Golden Visas Obtained through Real Estate Investments | 95% |

| Golden Visas Obtained through Investment in Bank Deposits | 1.90% |

| Golden Visas Obtained through Investment in Spanish Companies Shares | 1.2% |

| Golden Visas Obtained through Investment in Entrepreneurial Projects | 0.63% |

| Golden Visas Obtained through Investment in Spanish Funds | 0.32% |

| Golden Visas Obtained through Investment in Spanish Debt | 0.04% |

NEW: SPANISH GOVERMENT LOWERS GOLDEN VISA REQUIREMENTS

The Spanish Supreme Court has lowered the requirements for non-EU foreigners to obtain Spanish residency. While previously the golden visa was only granted to those who purchased a home built with a value of more than 500,000 euros, now the door has been opened to foreign investors seeking to develop or build their own home on the land previously purchased.

Get golden visa in Europe, the European golden visa.

There are more EU golden visa, although each country has its own criteria, the easiest to obtain is the Spanish golden visa. These are some of the countries that have their golden visas: golden visa in portugal, greece golden visa program, cyprus golden visa, italy golden visa…

How long can I spend annually in other countries in the Schengen area if I have a Spanish Golden Visa?

Benjamin,

With the golden visa you can stay as long as you want in Spain and then the 90 days rule as a tourist in any Schengen area.

Let me know if you have any questions.

Kind regards

We are 3 years holding a TIE but only visit 5 months /year. Is it possible to apply for a golden visa. We pass the necessary requirements having purchased a high value house 3 years ago.

If you meet all the requirements you can obtain this visa. We can help you through the whole process.

can the holder of a golden visa in Spain have the right to work in Spain? Is there a period of time before you could work? Are there any work restrictions.

Thomas,

one of our lawyers should be in contact with your questions about golden visa in spain

Kind regards,

We own a property in Spain valued at 450,000 euros. It’s currently on the market as is our UK home, Onceboth are sold we plan to buy a signficant property in Spain and apply for residency. Should we apply for a non-economic visa short term or just wait and apply for the golden visa downstream?

One of our lawyers will contact you to answer your questions.

Dear Sir/Madam, I have lived in Spain for almost 2 years without permit of residence. Am I eligible for Golden Visa program? Thanks for your kind attention. Best regards, Hollis

If you are in Spain illegally you will not be able to apply for the golden visa as you will first have to regularise your situation (leaving the country) in order to be able to apply for the golden visa. We will be happy to help you through the whole process of getting your golden visa.

Hi

If a couple who are not married use the Property route to a golden visa, do both qualify for the visa? I am looking at spending aprx Euro 700k

Hi Chris,

The property has to be purchased by one of the two members and then show more documents proving your relationship but we have obtained the golden visa for unmarried couples.

It seems the duration of the golden visa has increased to 3 years from 2 years if applied for from within Spain. Has the amount of financial means increased as well? I believe it was previously 56K euros for the two year duration is it now higher if it’s valid for 3 years?

I did hear rumours the golden visa for Spain may be cancelled similar to Portugal and Ireland. Has the recent election in Spain shed new light on this rumour?

It is only rumors that the golden visa in Spain is going to disappear… we are applying every week to obtain the golden visa for our clients.

On the other hand, if they have increased from 2 to 3 years but it is only necessary to prove that you have two years of savings.

Hi How long is it taking to process the application once submitted and can you track progress

If the presentation is in Spain, it is 20 working days. We submit several golden visas each week and all are approved in less than 20 working days.

Thanks for your site and services. For how long after purchasing property can you apply for the Golden Visa?

We have sent you all the information by email for the golden visa requirements in Spain 2023 and the time required to obtain the visa.

Hi there,

My husband and I have Golden Visa permits, which were issued in March 2022. Since then, we have been residing in Spain full time. We need to request a renewal of our visas and were wondering if you could let us know what documents are required to submit with our renewal application?

Thank you

Shiva

We can help you through the entire process of renewing your golden visa.

Hi,

If I am already living in Spain on a one year “no lucrativa” visa, can I still apply for a Golden Visa and can I do it from within Spain?

Regards

Emma

Emma,

Yes you can obtain the golden visa if you currently have the non-lucrative visa but you have to obtain the golden visa without the NLV having expired, we can help you through the whole process.

Hi, Im from the Philippines. My wife and I are interested in the Golden Visa, via the Real Estate Investment.

What is the proper procedure? Do we need to buy the property first?

Thank you!

You have to buy the property first, register the property at the land registry and when it is registered submit your visa application, in 20 days you will have the golden visa approval. We have contacted you to explain the process in detail.

The Golden Visa in Spain is a great opportunity for individuals looking to move to Spain and enjoy its benefits, and this article provides valuable information on the requirements and a fast application process.

Hi,

This is really helpful. We want to apply for a Golden Visa before our NLV expires. From you answer to Emma we can do it whilst in Spain. Is there a different procedure and paperwork required for doing this? Would be interested to know your fees to help with this.

Regards

A different Emma

We have sent you an email with all the details.

We have purchased >500k Euro’s of property in Spain, but heard that we also have to have an active bank account in a Spanish institution as well to qualify for the Golden Visa.

Questions – what is the additional Spanish bank deposit requirement ?

First of all you don’t need to have money in a Spanish bank, you can prove that you have money in any other bank. On the other hand, you need to prove about 30.000€ for the main applicant of the visa.

I am a retired UK national and plan to sell my property in the UK and purchase a property in Spain well in excess €500,000 and apply for the Golden Visa for myself and my dependents. My wife and her daughter (aged 17) both hold Nepali passports and are currently in Nepal awaiting the result of a UK partner visa that is dependent on passing an English test. If successful their partner visas will only permit them to stay in the UK and not travel to Spain or elsewhere in Europe. We are legally married and have a Nepali Court Marriage Certificate.

My question is…will my Nepali wife and her daughter automatically be granted Spanish residency with my Golden Visa application, or will it be necessary for them to obtain an extra entry visa from the Spanish Embassy in Nepal?

I have owned a property in Spain for about 5 years, but I plan to purchase another over €500,000. I have held an NIE since December 2018.

We have sent you an email with all the information!

Hi, We already own a property for which we paid 750 euro 20 years ago. We spend around 5 months a year in Marbella and loved the flexibility before Brexit. Is there any way we could apply for a golden visa?

Many thanks

Glen &Dawn Williams

We have sent you an email with all the details.

If buying a property of at least €500,000 as a couple, with children, does that mean that both parents and children will be granted golden visas?

Does the golden visa mean that both parents will be able to work legally, either employed or self employed?

Can the children enrol into the public school system as a golden visa recipient?

Thank you!

We have sent you an email with all the details.

I have looked online for what the interest rate would be on a 1 million euro bank deposit.

I have not seen this yet. I have even seen that the interest rate could be 0%. Is this possible?

We have sent you an email with all the details and explaining the golden visa process.

Can you also help with providing qualified licensed professional real estate brokers in Marbella to help us find and secure a property? help us with opening bank account and money transfer? can you provide a list of qualified licensed realtors that speak English

Yes, we have sent you an email.

My partner has obtained an investor visa from a UK consulate and it is valid for one year. We assume the TIE card will also be only for one year. How much do you charge to deal with the renewal of the visa when the time comes?

You can send us a contact form if you need our services to renew your Golden Visa.